End-to-End Insurance Platforms: Unlocking P&C Success

Most british and European insurers are battling fractured IT systems while aiming to keep pace with rapidly evolving customer demands. For mid-sized property and casualty organisations in Central Europe, the struggle to modernise often comes with mounting complexity and hidden costs. Research from The Geneva Association reveals fragmented platforms can increase operational expenditures by up to 30 percent compared to unified systems. This article highlights how end-to-end insurance platforms offer practical solutions, helping leaders streamline operations, transform customer experience, and position their company for continuous digital success.

Table of Contents

- Defining End-to-End Insurance Platforms

- Types of Digital Insurance Solutions

- How Platforms Enhance Insurance Operations

- Ensuring Integration and Evergreen Compliance

- Financial Impacts and Strategic Advantages

- Pitfalls of Disconnected and Legacy Systems

Key Takeaways

| Point | Details |

|---|---|

| End-to-End Platforms Enhance Efficiency | Comprehensive platforms streamline operations and reduce technological complexity, allowing insurers to operate more effectively. |

| Digital Solutions Drive Innovation | Modern digital insurance solutions facilitate new business models and improve customer engagement through advanced technologies. |

| Integration is Key for Success | Seamless integration and built-in compliance mechanisms are crucial for insurers to adapt to evolving regulatory requirements and market demands. |

| Legacy Systems Present Challenges | Maintaining outdated infrastructures severely limits insurers’ ability to innovate, respond quickly, and provide seamless customer experiences. |

Defining End-to-End Insurance Platforms

End-to-end insurance platforms represent sophisticated digital infrastructures designed to transform how insurers operate across the entire insurance value chain. These comprehensive systems integrate multiple functional processes into a single, streamlined technological ecosystem, enabling property and casualty (P&C) insurers to modernise their operations and enhance customer experiences.

At their core, these platforms encompass a holistic approach to insurance management, covering critical domains such as product design, underwriting, policy administration, claims processing, billing, and customer relationship management. Comprehensive digital solutions are reshaping the insurance landscape, facilitating seamless technological integration that supports rapid innovation and operational efficiency. By consolidating disparate systems into a unified platform, insurers can dramatically reduce technological complexity and accelerate their digital transformation strategies.

The Geneva Association’s research highlights that end-to-end insurance platforms are not merely technological tools but strategic enablers that connect insurers, customers, and partners through multifunctional digital channels. These platforms create unprecedented opportunities for developing new business models, improving customer engagement, and responding swiftly to evolving market dynamics. Key characteristics include API-first architectures, cloud-native infrastructures, and modular designs that allow insurers to adapt quickly and scale their operations effortlessly.

Pro tip: When evaluating end-to-end insurance platforms, prioritise solutions that offer seamless integrations, robust data analytics capabilities, and flexible architectures that can evolve with your organisation’s strategic objectives.

Types of Digital Insurance Solutions

Digital insurance solutions have evolved into a sophisticated ecosystem of technological platforms designed to address various strategic and operational challenges within the insurance industry. Emerging digital insurance archetypes now encompass multiple specialised roles, ranging from innovation enablers to comprehensive transformation mechanisms.

The European insurance landscape presents a nuanced categorisation of digital solutions, broadly classified into distinct technological approaches. These include pure digital distribution channels, embedded insurance products, AI-driven underwriting platforms, blockchain applications, and advanced digital claims management systems. Each solution targets specific inefficiencies within traditional insurance processes, leveraging cutting-edge technologies to enhance operational efficiency, customer engagement, and strategic agility.

Key categories of digital insurance solutions can be systematically understood through their primary functional objectives. Some platforms focus on digital distribution, enabling insurers to reach customers through multiple online channels, while others specialise in data analytics, using machine learning algorithms to refine risk assessment and pricing models. Integrated platforms offer comprehensive capabilities that span product design, policy administration, customer relationship management, and claims processing, representing the most sophisticated approach to digital transformation in the insurance sector.

Here is a summary of leading types of digital insurance solutions and their primary aims:

| Solution Type | Core Objective | Example Technology |

|---|---|---|

| Digital distribution channels | Expand online customer access | Mobile apps, web portals |

| Embedded insurance products | Integrate cover within purchases | E-commerce integration |

| AI-driven underwriting | Automate risk assessment | Machine learning models |

| Blockchain applications | Secure records, prevent fraud | Smart contracts |

| Digital claims management | Speed up claims handling | Automated claims engines |

Pro tip: When selecting digital insurance solutions, prioritise platforms with modular architectures that allow seamless integration and scalability across different operational domains.

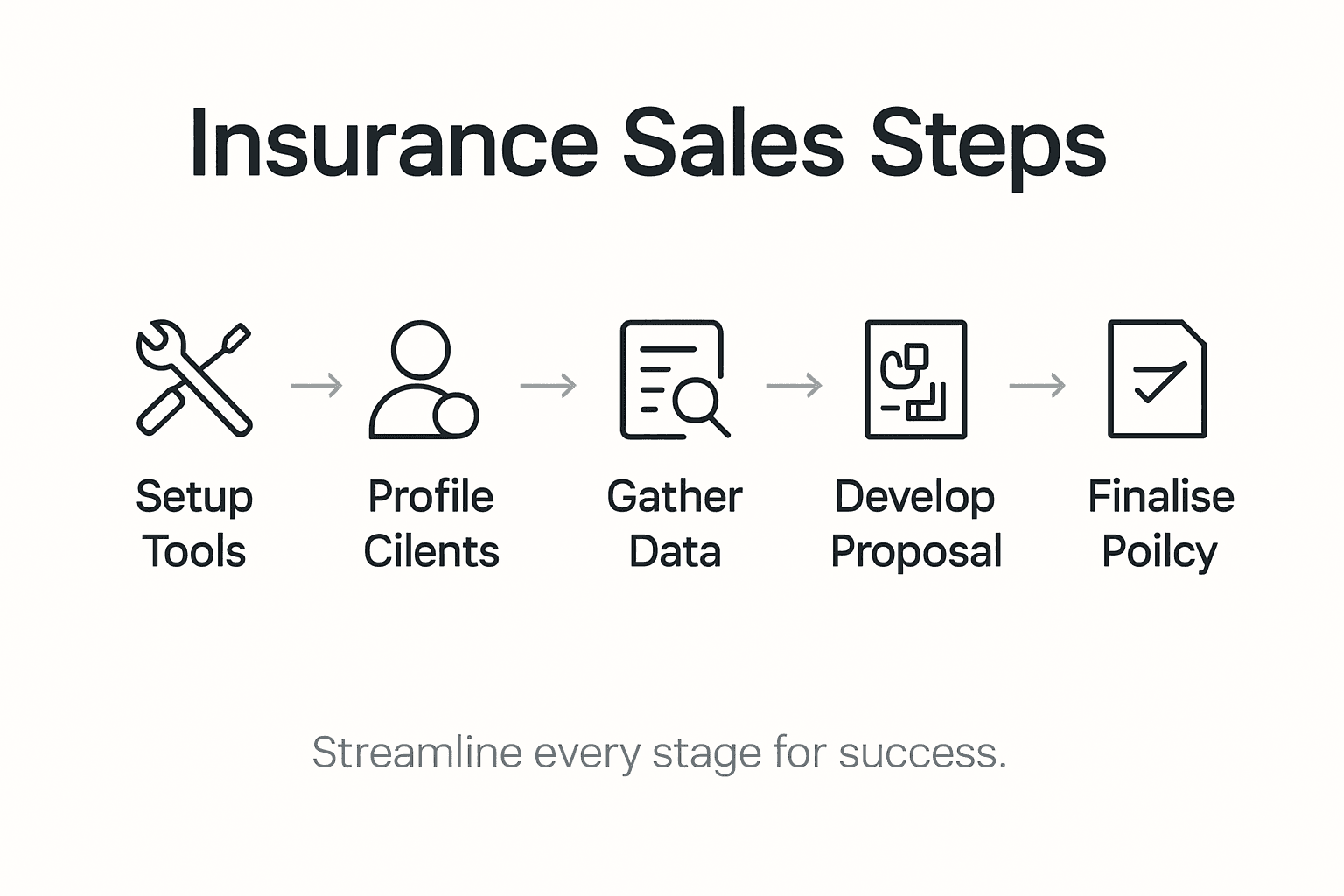

How Platforms Enhance Insurance Operations

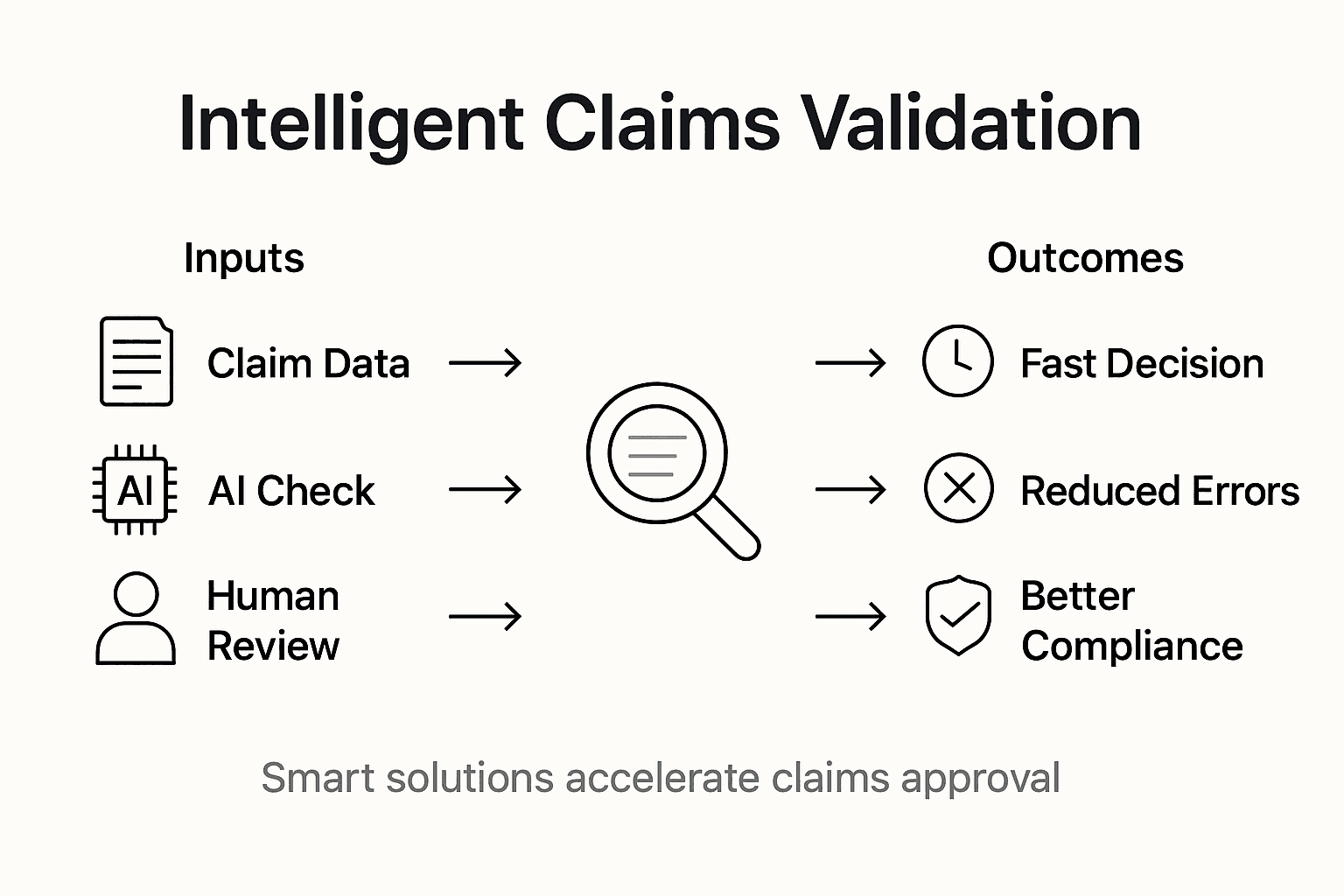

End-to-end insurance platforms fundamentally transform operational efficiency by integrating advanced technologies across the entire insurance value chain. Digital platforms revolutionise insurance operations through comprehensive technological ecosystems that streamline complex processes and enable unprecedented levels of operational agility.

These sophisticated platforms leverage cutting-edge technologies like artificial intelligence, Internet of Things (IoT), and blockchain to optimise critical insurance functions. By implementing intelligent automation, insurers can significantly reduce manual intervention in underwriting, claims processing, and risk assessment. This technological integration enables more accurate risk evaluation, faster decision-making, and enhanced customer experiences through real-time data processing and intelligent workflow management.

Key operational enhancements delivered by modern digital platforms include intelligent data analytics, seamless process integration, and dynamic risk management capabilities. Platforms enable insurers to move beyond traditional siloed operational models, creating interconnected systems that provide holistic insights, improve resource allocation, and support rapid product innovation. By consolidating multiple operational domains into a unified technological framework, insurers can achieve greater transparency, reduce operational redundancies, and respond more effectively to evolving market dynamics.

Pro tip: When evaluating digital insurance platforms, assess their ability to integrate multiple technological capabilities while maintaining flexibility for future technological adaptations.

Ensuring Integration and Evergreen Compliance

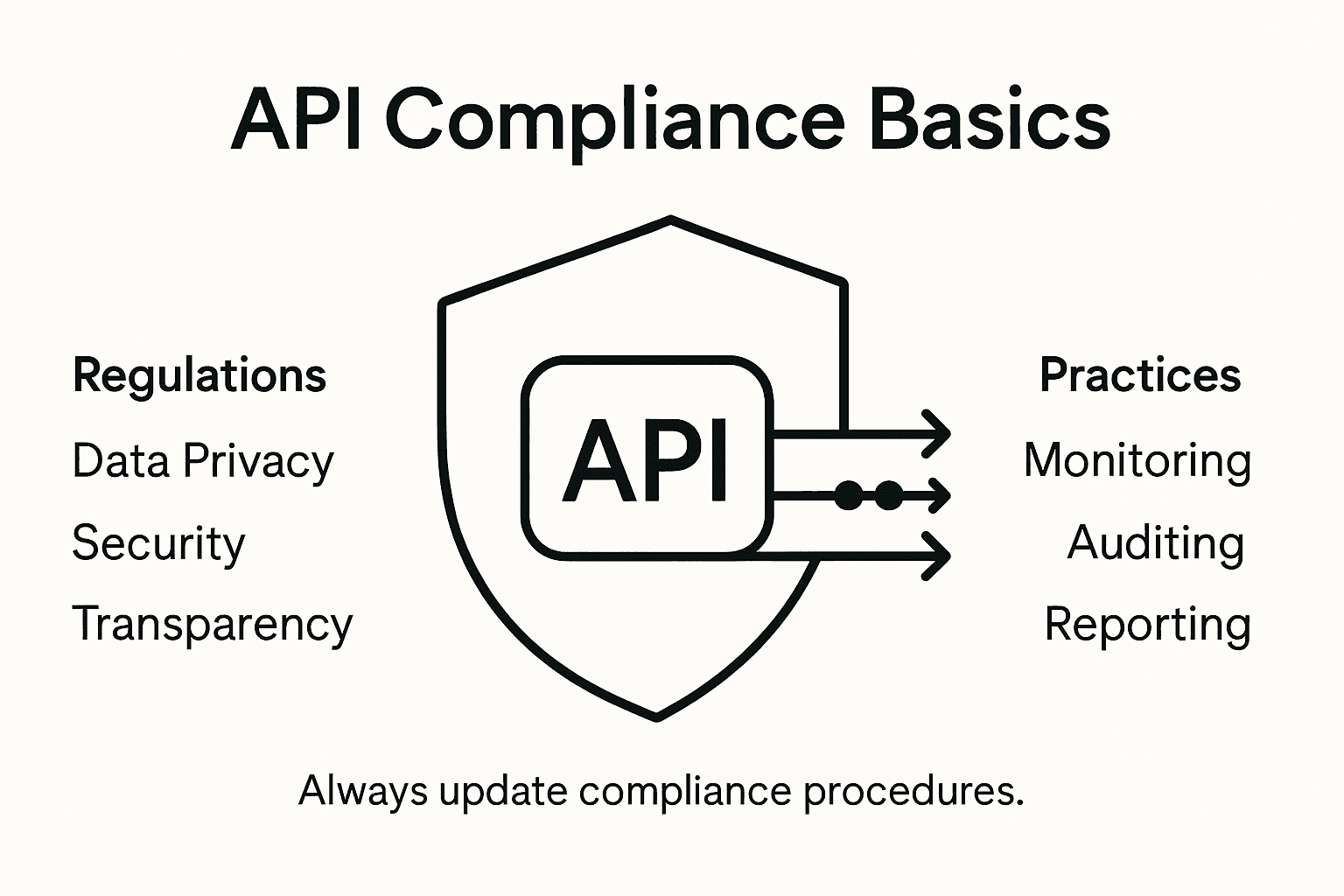

Ensuring seamless integration and continuous regulatory compliance represents a critical challenge for modern property and casualty insurers seeking digital transformation. Regulatory compliance frameworks now demand sophisticated technological approaches that enable automatic policy updates and procedural adaptations to meet evolving legal requirements in the European insurance landscape.

Modern digital platforms address compliance challenges through intelligent technological solutions that embed regulatory monitoring directly into operational systems. By utilising advanced regulatory technology (RegTech), insurers can implement automated compliance mechanisms that continuously scan and adapt to new legislative requirements. These sophisticated systems leverage artificial intelligence and machine learning algorithms to track regulatory changes, assess potential impacts, and automatically adjust internal processes, ensuring insurers remain consistently aligned with current legal standards.

The integration of compliance features within digital insurance platforms requires a multilayered approach that encompasses technological flexibility, comprehensive monitoring, and proactive risk management. European regulatory bodies emphasise the importance of building adaptive technological architectures that can seamlessly incorporate new compliance requirements without disrupting existing operational workflows. This approach enables insurers to maintain operational resilience, reduce compliance-related risks, and respond rapidly to complex regulatory environments.

Pro tip: Prioritise digital platforms with built-in regulatory adaptation capabilities and granular compliance tracking mechanisms to ensure continuous alignment with evolving legislative standards.

Financial Impacts and Strategic Advantages

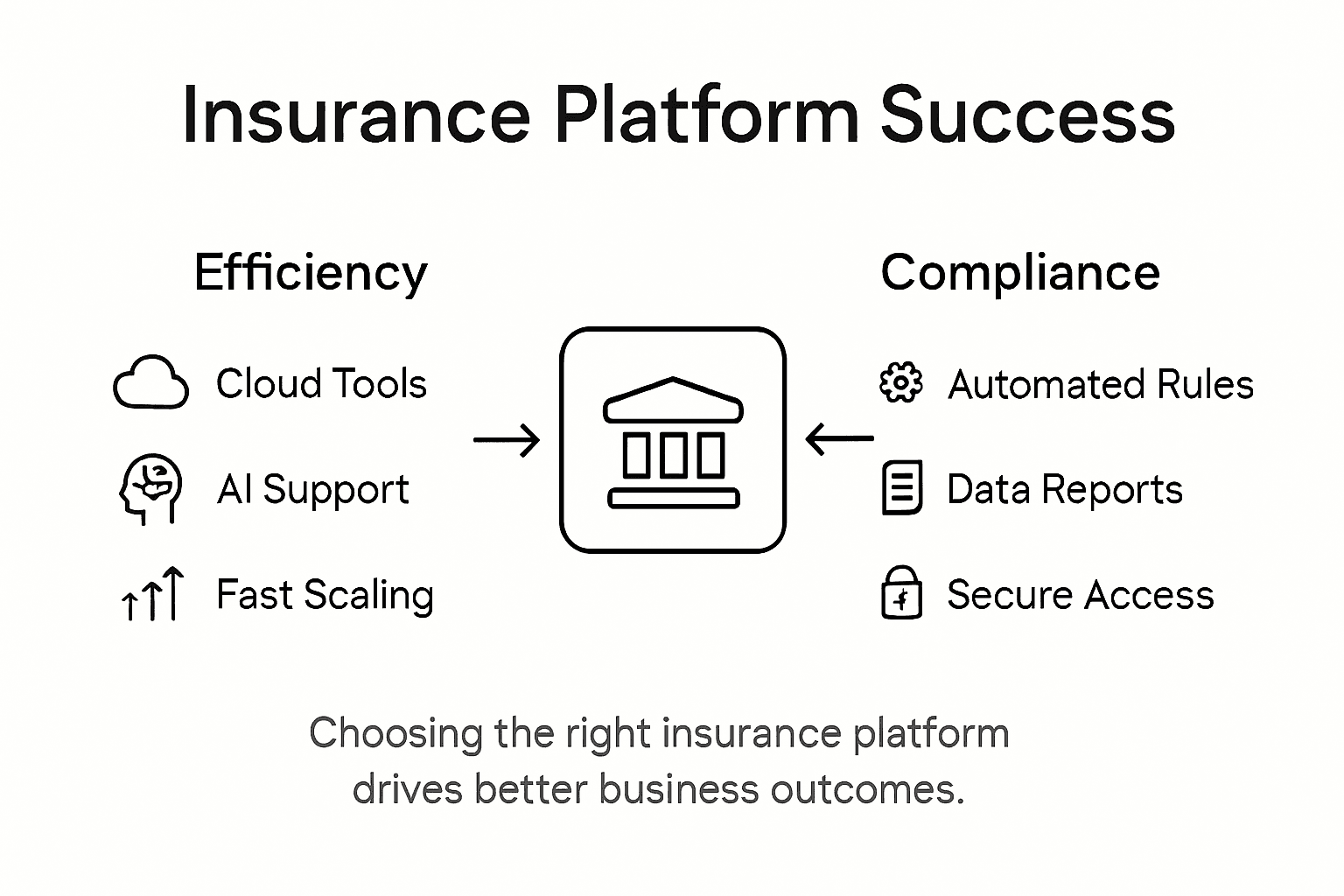

Digital insurance platforms are transforming the financial landscape for property and casualty insurers by delivering substantial strategic and economic benefits. Platforms provide critical advantages that enable business model innovation and facilitate strategic digital ecosystem partnerships, creating unprecedented opportunities for revenue generation and operational optimisation.

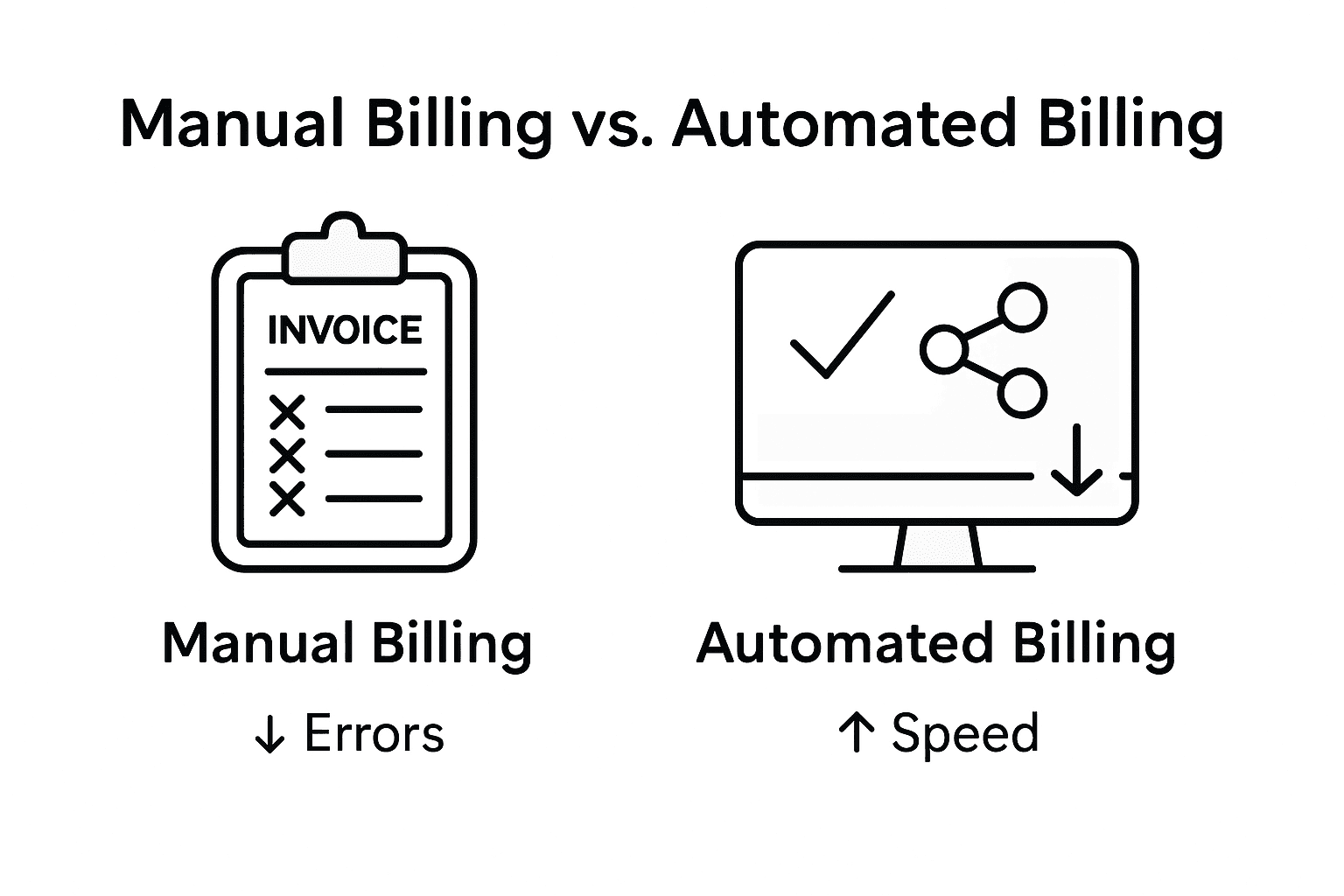

The financial impacts of implementing comprehensive digital platforms extend far beyond immediate cost savings. These sophisticated technological solutions drive substantial operational efficiencies by reducing manual processes, minimising administrative overhead, and streamlining complex insurance workflows. Advanced platforms leverage intelligent automation and data analytics to enhance risk assessment, improve pricing accuracy, and create more personalised insurance products that can potentially increase customer acquisition and retention rates.

Strategic advantages of digital insurance platforms include enhanced market responsiveness, improved competitive positioning, and greater organisational resilience. By adopting flexible, cloud-native technological architectures, insurers can quickly adapt to changing market conditions, develop innovative product offerings, and respond more effectively to emerging customer needs. These platforms enable insurers to break free from legacy system constraints, accelerate digital transformation initiatives, and create more agile, data-driven organisational models that can rapidly evolve in complex and dynamic insurance markets.

Pro tip: Conduct a comprehensive total cost of ownership analysis when evaluating digital platforms, considering both immediate implementation expenses and long-term strategic value potential.

Pitfalls of Disconnected and Legacy Systems

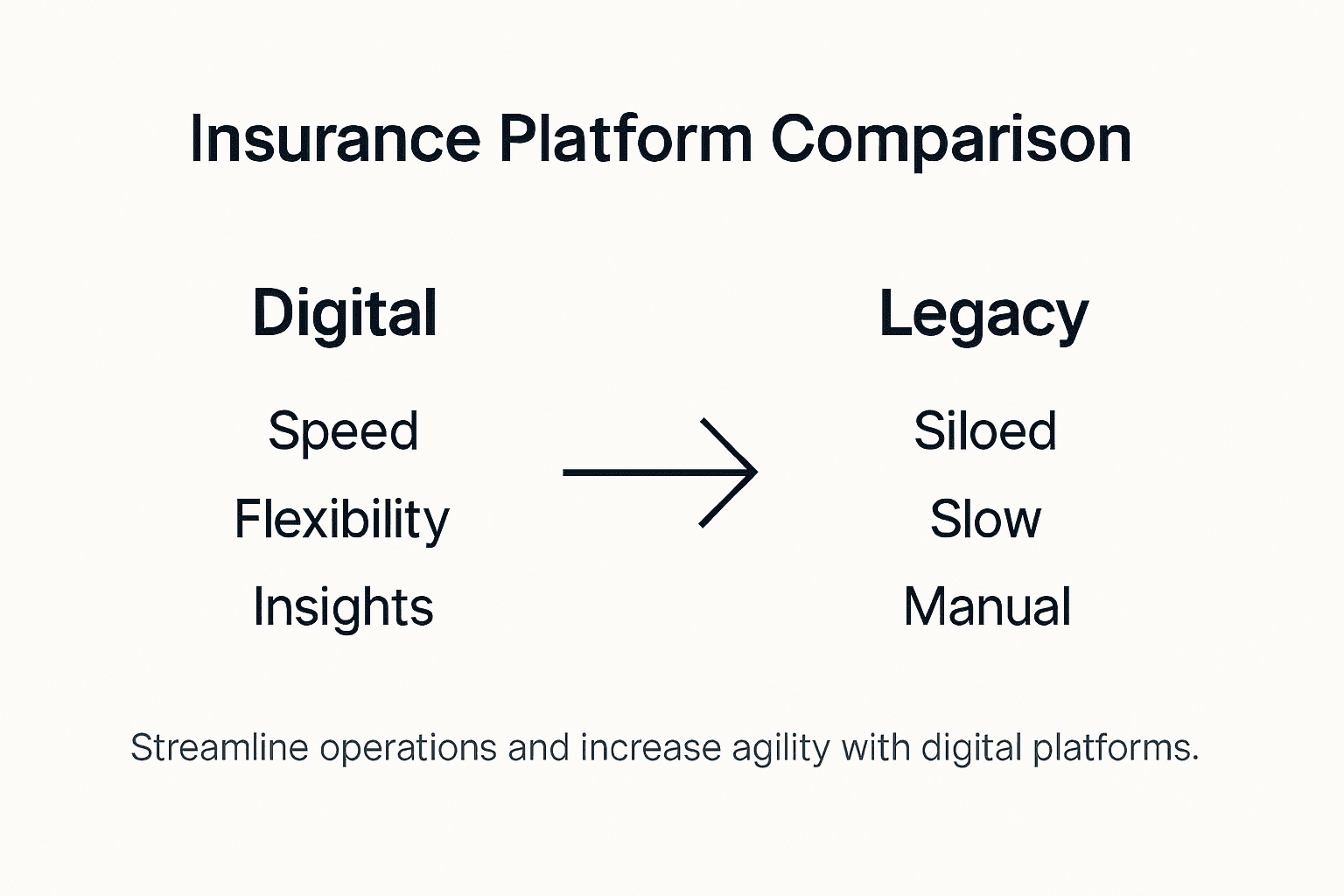

Legacy insurance systems represent significant technological barriers that impede insurers’ ability to innovate and compete effectively in modern digital markets. Disconnected technological infrastructures create substantial operational risks and inefficiencies across insurance value chains, undermining organisations’ strategic capabilities and customer engagement potential.

These fragmented systems generate multiple critical challenges for property and casualty insurers. Technological silos prevent seamless data integration, creating bottlenecks in critical processes such as underwriting, claims management, and customer service. Insurers relying on legacy infrastructures frequently experience reduced operational agility, increased compliance complexity, and significantly higher maintenance costs. The inability to rapidly adapt technological capabilities directly constrains an organisation’s capacity to respond to emerging market opportunities and evolving customer expectations.

The strategic implications of maintaining disconnected systems extend beyond immediate operational limitations. These technological constraints fundamentally restrict insurers’ innovation potential, preventing them from implementing advanced analytics, personalised product development, and seamless digital customer experiences. By perpetuating outdated technological architectures, insurers risk becoming increasingly uncompetitive, facing higher customer churn rates, reduced market responsiveness, and diminished ability to leverage emerging technologies like artificial intelligence and machine learning.

The following table contrasts the impact of end-to-end digital platforms with legacy systems for insurers:

| Aspect | Digital Platforms | Legacy Systems |

|---|---|---|

| Efficiency | High automation, minimal manual input | Manual processes, slow workflow |

| Compliance | Built-in regulatory adaptation | Reactively updated, risk of lag |

| Innovation | Rapid product development, flexible | Hampered by outdated infrastructure |

| Customer Service | Seamless, omnichannel experiences | Fragmented, inconsistent interactions |

Pro tip: Develop a comprehensive digital transformation roadmap that prioritises gradual system modernisation, focusing on incremental improvements and strategic technology integration.

Unlock Seamless Transformation with IBSuite

The challenges of navigating disconnected legacy systems and meeting ever-evolving regulatory requirements can stall your path to operational excellence and innovation. As discussed in “End-to-End Insurance Platforms: Unlocking P&C Success”, insurers must prioritise API-first architectures, cloud-native infrastructures, and built-in regulatory adaptation to reduce complexity and accelerate growth. Overcoming manual processes and siloed data is key to unlocking better risk assessment, faster product launches, and superior customer engagement.

Insurance Business Applications (IBA) understands these pressures and offers IBSuite — an end-to-end, cloud-native platform designed specifically for property and casualty insurers seeking digital transformation. IBSuite supports the full insurance value chain with seamless integrations and Evergreen compliance updates, empowering your organisation to:

- Launch innovative products rapidly

- Simplify your IT landscape

- Adapt swiftly to market and regulatory changes

Explore how IBSuite can help you modernise your core systems and embrace new distribution models by booking a personalised demo today at book a demo. Don’t let legacy technology hold you back. Take the first step towards a more agile future with Insurance Business Applications now.

Frequently Asked Questions

What are end-to-end insurance platforms?

End-to-end insurance platforms are comprehensive digital solutions that integrate multiple insurance processes, such as product design, underwriting, policy administration, claims processing, billing, and customer relationship management, into a unified system.

How do these platforms enhance operational efficiency in the insurance industry?

These platforms leverage advanced technologies like artificial intelligence and automation to streamline critical processes, reduce manual intervention, and improve decision-making. This leads to faster, more accurate operations and enhanced customer experiences.

What types of digital insurance solutions exist?

Digital insurance solutions vary widely and include digital distribution channels, embedded insurance products, AI-driven underwriting, blockchain applications, and digital claims management systems, each targeting specific inefficiencies within traditional insurance processes.

How can insurers ensure compliance with evolving regulations using digital platforms?

Digital platforms can incorporate regulatory technology (RegTech) features that automatically monitor and adapt to new legislation, ensuring ongoing compliance through intelligent systems that adjust internal processes without disrupting operations.

Recommended

- Why Choose End-to-End Platforms for Insurers – Digital Insurance Platform | IBSuite Insurance Software | Modern Insurance System

- Opportunities and Challenges for P&C Insurers: Embracing Insurtech – Digital Insurance Platform | IBSuite Insurance Software | Modern Insurance System

- Complete Guide to Integrated Insurance Platforms – Digital Insurance Platform | IBSuite Insurance Software | Modern Insurance System

- 7 Types of P&C Insurance Distribution for Insurers