Insurance companies run on complex technology and the right core systems drive everything from policy management to claims. Some insurers have managed to cut processing times by up to 70 percent with modern core platforms. That sounds huge for any business. Yet most people still think core systems just do paperwork in the background. The real surprise is these platforms actually shape how fast insurers can launch products, respond to disasters, and even adapt to new risks overnight.

Table of Contents

- What Are Insurance Core Systems And Their Functions?

- Why Insurance Core Systems Matter For Insurers

- How Insurance Core Systems Integrate With Business Processes

- Key Components Of Insurance Core Systems

- Real-World Impact Of Insurance Core Systems On Decision Making

Quick Summary

| Takeaway | Explanation |

| Insurance core systems enhance operational efficiency | These systems automate workflows and reduce manual intervention, streamlining processes for faster response times. |

| Strategic assets support competitive advantage | Core systems allow insurers to develop products quickly and adapt to changing market demands, enhancing overall strategic position. |

| Data integration improves decision-making | By aggregating data from various sources, these systems enable better risk assessment and resource allocation, leading to informed choices. |

| Regulatory compliance is facilitated | Advanced reporting and data tracking features ensure insurers meet legal standards while maintaining transparency in operations. |

| Emerging technologies boost system resilience | Core systems can incorporate AI and machine learning, ensuring adaptability in a rapidly evolving digital landscape. |

What Are Insurance Core Systems and Their Functions?

Insurance core systems represent the foundational technological infrastructure that powers insurance operations, serving as the central nervous system for property and casualty (P&C) insurers. These complex software platforms enable insurers to manage critical business processes seamlessly, from policy creation to claims processing.

Core System Components and Architecture

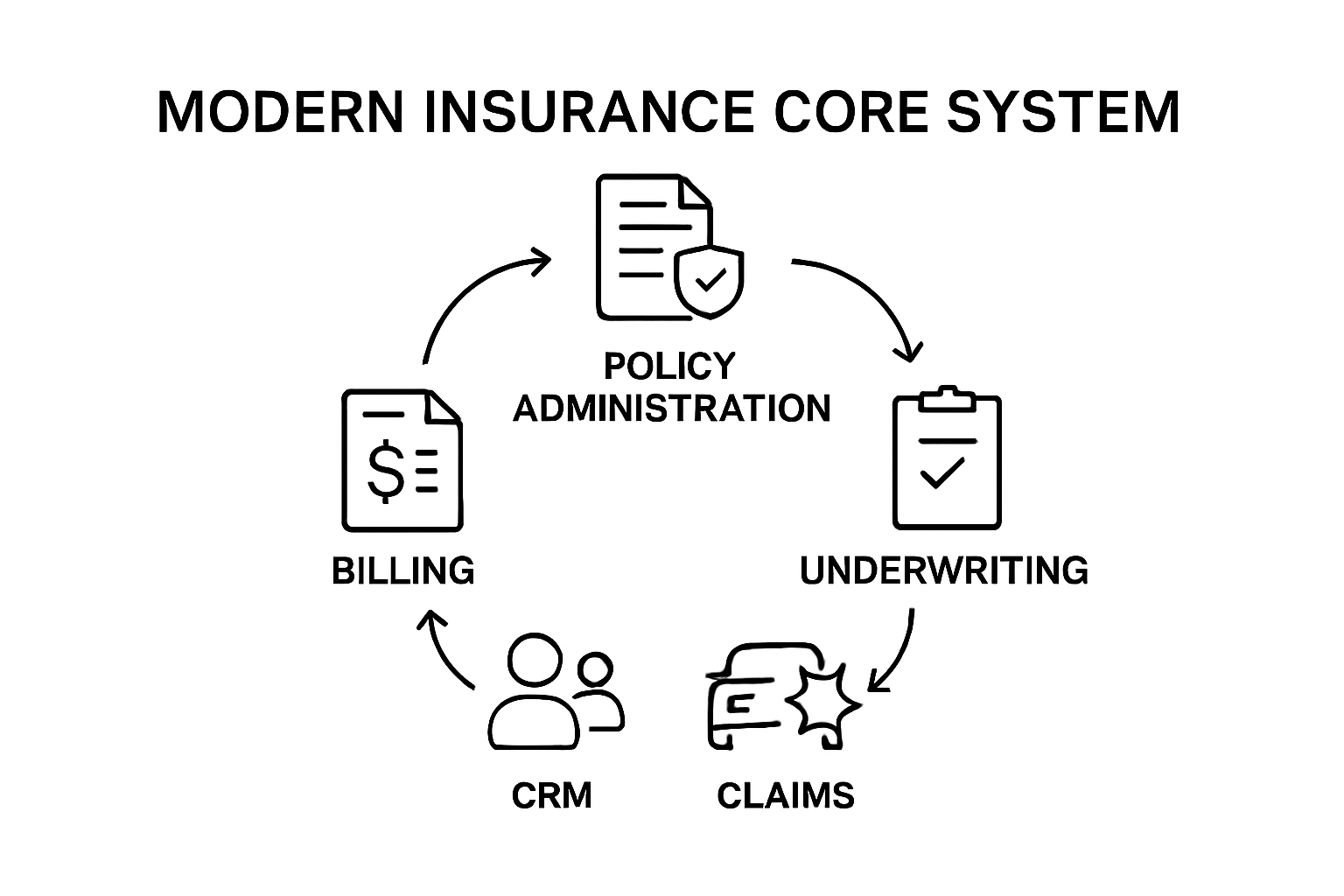

At their essence, insurance core systems are comprehensive platforms designed to streamline and automate essential insurance workflows. According to International Association of Insurance Supervisors, these systems typically encompass multiple interconnected modules that support the entire insurance value chain.

Key components of insurance core systems include:

- Policy administration systems

- Underwriting management platforms

- Claims processing solutions

- Billing and payment systems

- Customer relationship management (CRM) interfaces

Functional Purpose and Strategic Importance

Modern insurance core systems go beyond mere operational support. They represent strategic technological assets that enable insurers to adapt quickly to market changes, launch innovative products, and enhance customer experiences. Read more about modernization strategies for insurers, which highlights the critical role of robust core systems in digital transformation.

These systems function as integrated platforms that collect, process, and analyze vast amounts of data, enabling insurers to make informed decisions, manage risks effectively, and maintain regulatory compliance. By providing real-time insights and automating complex business processes, insurance core systems help organizations remain competitive in an increasingly digital marketplace.

The following table summarizes the main components of modern insurance core systems alongside their primary functions, helping readers quickly grasp the role each element plays within the ecosystem.

| Core Component | Primary Function |

| Policy Administration | Manages the full policy lifecycle and renewals |

| Underwriting Management | Assesses risk and sets pricing for insurance policies |

| Claims Processing | Handles claim intake, assessment, and settlement |

| Billing and Payment | Manages premium collection and transactions |

| Customer Relationship Management | Tracks customer engagements and service delivery |

Why Insurance Core Systems Matter for Insurers

Insurance core systems have evolved from basic record-keeping tools to sophisticated strategic platforms that fundamentally transform how insurers operate, compete, and deliver value to customers. Understanding their critical importance requires examining their multifaceted role in modern insurance ecosystems.

Strategic Business Transformation

Core systems are no longer mere technological infrastructure but strategic assets that drive competitive advantage. According to the National Association of Insurance Commissioners, these systems enable insurers to implement comprehensive Enterprise Risk Management (ERM) strategies, leading to increased operational efficiencies and more robust risk control mechanisms.

Key strategic benefits include:

- Accelerated product development and market launch capabilities

- Enhanced data analytics and predictive modeling

- Improved regulatory compliance and reporting

- Seamless integration with emerging technologies

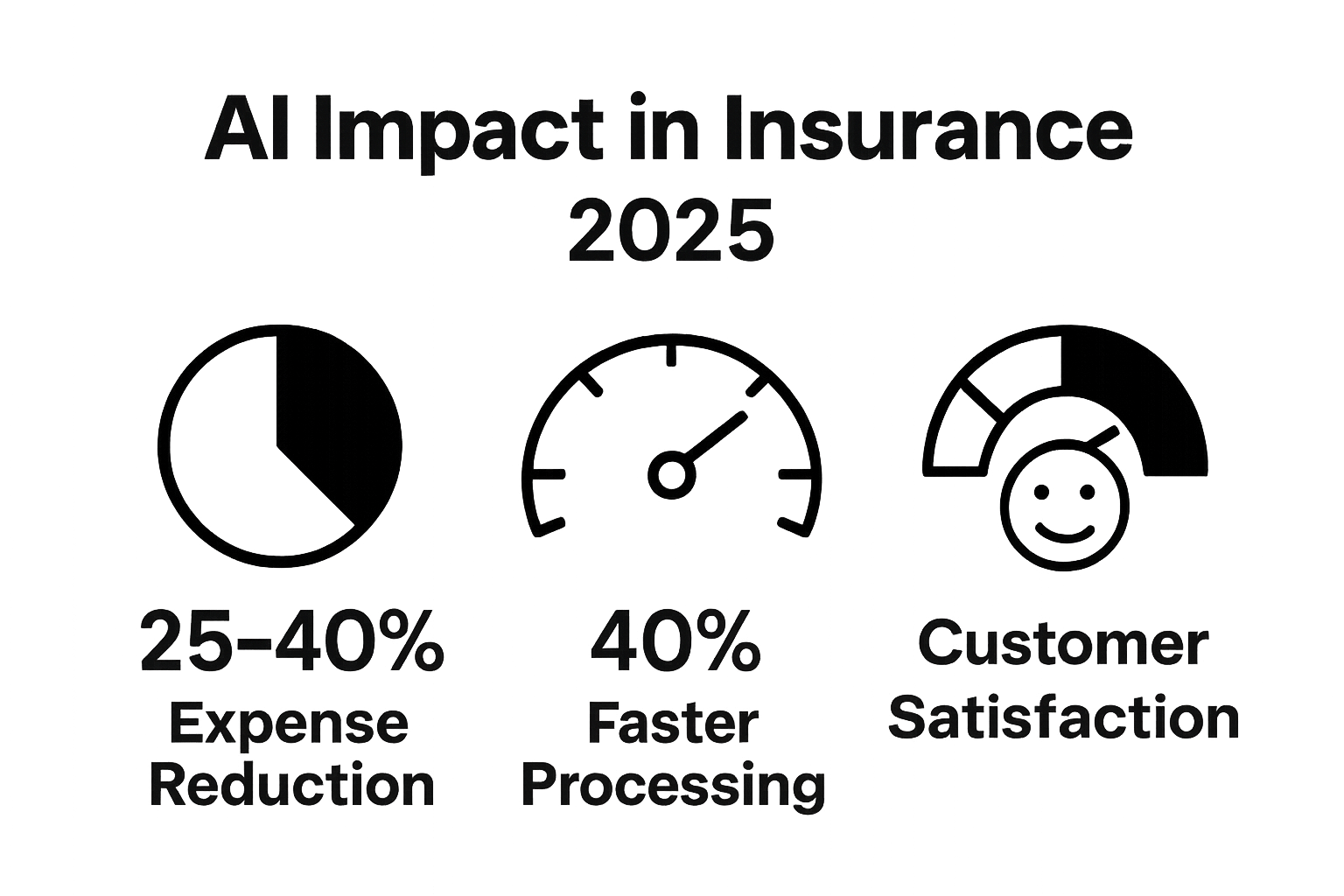

Operational Efficiency and Customer Experience

Modern insurance core systems directly impact an organization’s ability to meet evolving customer expectations. Learn more about multi-core insurance strategies that can help insurers adapt to changing market dynamics.

By automating complex workflows, reducing manual interventions, and providing real-time insights, these systems enable insurers to streamline operations, minimize processing times, and deliver more personalized customer experiences.

The ability to quickly adapt policy configurations, respond to customer inquiries, and process claims efficiently has become a critical differentiator in a highly competitive insurance landscape.

Risk Management and Technological Resilience

Insurance core systems serve as robust risk management platforms that help organizations navigate increasingly complex regulatory environments. They provide comprehensive data integration, advanced analytics, and sophisticated reporting capabilities that allow insurers to identify, assess, and mitigate potential risks more effectively.

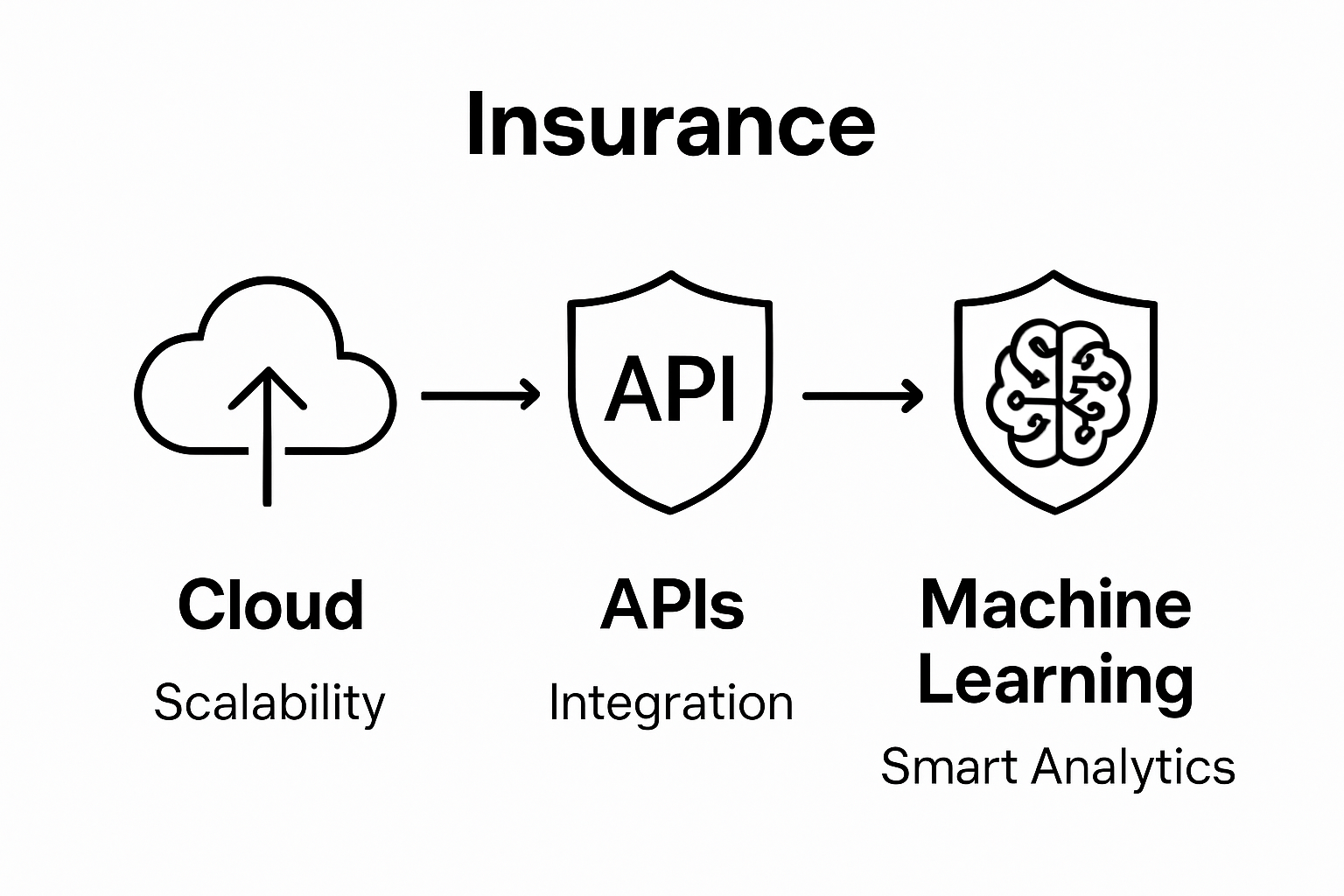

Moreover, these systems create technological resilience by offering scalable architectures that can rapidly incorporate emerging technologies like artificial intelligence, machine learning, and blockchain, ensuring insurers remain agile and forward-thinking in a rapidly evolving digital ecosystem.

To clarify the strategic impacts of insurance core systems, this table compares the key areas of benefit and summarizes how core systems address each one for insurers.

| Strategic Area | How Core Systems Provide Value |

| Product Development | Accelerate market launch through rapid configuration and rollout |

| Data Analytics | Enable predictive modeling and actionable business insights |

| Operational Efficiency | Automate workflows and reduce manual work for faster processing |

| Regulatory Compliance | Streamline reporting and ensure auditable operational transparency |

| Tech Adaptability | Integrate emerging technologies and scale system capabilities with ease |

How Insurance Core Systems Integrate with Business Processes

Insurance core systems act as sophisticated digital connectors that seamlessly bridge technological capabilities with complex organizational workflows. Their integration approach transforms traditional insurance operations by creating fluid, interconnected business processes that enhance efficiency and adaptability.

Process Mapping and Workflow Automation

Modern core systems enable comprehensive process mapping that allows insurers to digitize and optimize entire operational sequences. According to CORDIS European Research Information, advanced business process management systems can dramatically improve core insurance functions like underwriting and claims processing by standardizing and automating critical workflows.

Key integration mechanisms include:

- Automated data capture and validation

- Real-time process tracking and monitoring

- Configurable workflow rules and decision engines

- Seamless cross-departmental communication interfaces

Data Integration and Interoperability

Learn more about overcoming integration challenges in complex insurance technology environments. Core systems function as central data hubs that aggregate information from multiple sources, creating a unified view of organizational operations. By establishing robust APIs and integration protocols, these platforms enable smooth data exchange between different systems, departments, and external stakeholders.

This interoperability allows insurers to break down traditional technological silos, ensuring that critical information flows efficiently across policy administration, claims management, customer relationship systems, and financial reporting platforms.

Adaptive Process Optimization

Insurance core systems continuously evolve beyond static integration models. They leverage advanced analytics and machine learning algorithms to dynamically adjust business processes based on real-time performance data. By monitoring workflow efficiency, identifying bottlenecks, and suggesting optimization strategies, these systems help insurers maintain operational agility and responsiveness in a rapidly changing market landscape.

The ability to rapidly reconfigure processes, integrate emerging technologies, and respond to changing regulatory requirements makes modern core systems essential strategic assets for forward-thinking insurance organizations.

Key Components of Insurance Core Systems

Insurance core systems represent complex technological ecosystems composed of interdependent modules designed to streamline and optimize insurance operations. Understanding these critical components provides insight into how modern insurers leverage technology to drive efficiency and innovation.

Foundational System Architecture

According to the International Association of Insurance Supervisors, insurance core systems must adhere to robust governance and architectural principles that ensure comprehensive operational capabilities. The foundational architecture typically encompasses several integrated modules that work synergistically to support end-to-end insurance processes.

Critical architectural components include:

- Scalable cloud-based infrastructure

- Flexible API integration frameworks

- Secure data management protocols

- Configurable workflow engines

- Advanced analytics capabilities

Core Functional Modules

Explore modern insurance platform benefits that highlight the significance of comprehensive system components. Insurance core systems typically feature specialized modules that address specific operational requirements across the insurance value chain:

- Policy Administration: Manages policy lifecycle from creation to renewal

- Underwriting: Evaluates risk, determines pricing, and manages application processes

- Claims Management: Handles claims submission, assessment, and settlement

- Billing and Payments: Manages premium collection and financial transactions

- Customer Relationship Management: Tracks customer interactions and supports service delivery

Integration and Interoperability Framework

Modern insurance core systems are designed with robust integration capabilities that enable seamless communication between different technological components. These systems employ advanced middleware technologies, standardized data exchange protocols, and sophisticated integration layers that allow insurers to connect multiple internal and external systems efficiently.

The integration framework ensures that data flows smoothly across different modules, enabling real-time decision making, comprehensive reporting, and adaptive operational responses. By creating a unified technological ecosystem, insurers can overcome traditional technological barriers and create more agile, responsive business models.

Real-World Impact of Insurance Core Systems on Decision Making

Insurance core systems have revolutionized organizational decision-making by transforming raw data into actionable insights, enabling insurers to make more precise, timely, and strategic choices across their entire operational landscape. These advanced technological platforms have fundamentally altered how insurance organizations approach complex business challenges.

Risk Assessment and Predictive Analytics

According to the OECD Digital Transformation Report, modern core systems dramatically enhance decision-making capabilities through sophisticated predictive analytics. By aggregating and analyzing vast amounts of historical and real-time data, these systems enable insurers to:

- Develop more accurate risk profiles

- Predict potential claim probabilities

- Identify emerging market trends

- Optimize pricing strategies

- Anticipate potential financial vulnerabilities

Strategic Resource Allocation

Explore modern insurance platform insights to understand how technological capabilities transform strategic planning. Core systems provide granular, comprehensive insights that allow leadership to make data-driven decisions about resource allocation, helping organizations:

- Prioritize investment opportunities

- Reallocate resources based on performance metrics

- Identify operational inefficiencies

- Design targeted product development strategies

- Optimize workforce management

Regulatory Compliance and Operational Transparency

Insurance core systems have become critical tools for ensuring regulatory compliance and maintaining operational transparency. By creating comprehensive, auditable data trails and generating real-time reporting capabilities, these systems help organizations:

- Demonstrate regulatory adherence

- Quickly respond to compliance inquiries

- Generate precise financial and operational reports

- Track and document decision-making processes

- Maintain robust governance frameworks

Through advanced data integration and analytics, insurance core systems have transformed decision-making from a reactive to a proactive discipline, enabling organizations to anticipate challenges, optimize performance, and create more strategic, informed approaches to complex business environments.

Transform Insurance Operations With IBSuite: Your Core System Modernization Partner

Is your team struggling with outdated core systems, slow product launches, or disconnected workflows? The article “Understanding Insurance Core Systems Explained” outlined how crucial it is for insurers to have a unified, data-driven platform that streamlines policy administration, claims, billing, and customer engagement. Many insurers face challenges such as lack of real-time insights, integration hurdles between legacy systems, and difficulty adapting to regulatory changes or market demands. You deserve a solution built for modern insurance challenges—one that supports the full policy lifecycle and empowers you to innovate with confidence.

Imagine what your business could achieve with a platform that transforms complexity into simplicity. Insurance Business Applications (IBA) delivers IBSuite, a secure, cloud-native, API-first platform trusted by global leaders for true end-to-end insurance management. Move faster, cut IT chaos, and wow your customers with a platform that enables seamless integrations and Evergreen updates. Start your digital transformation journey and contact us for a personalized consultation or read more about overcoming integration challenges to discover how IBSuite helps you stay ahead. Don’t let legacy systems hold you back. Act now to lead the future of insurance.

Frequently Asked Questions

What are insurance core systems?

Insurance core systems are foundational technological platforms that support and streamline the essential operations of property and casualty (P&C) insurers, including policy administration, claims processing, and customer relationship management.

Why are insurance core systems important for insurers?

These systems are crucial because they enhance operational efficiency, improve customer experiences, facilitate regulatory compliance, and empower insurers to adapt to market changes and leverage data analytics for strategic decision-making.

How do insurance core systems improve operational efficiency?

Insurance core systems improve efficiency by automating complex workflows, reducing manual interventions, and providing real-time insights that enable insurers to streamline operations and speed up processes such as claims handling and policy management.

What components are included in insurance core systems?

Key components typically include policy administration systems, underwriting management platforms, claims processing solutions, billing and payment systems, and customer relationship management (CRM) interfaces.

Machine learning algorithms transform risk assessment, allowing more precise and dynamic pricing models.

Machine learning algorithms transform risk assessment, allowing more precise and dynamic pricing models.