In a world where technology is transforming every aspect of our lives, digitization is no longer an option for insurers. While known for its legacy systems and traditional processes, a handful of digital trends have been poised and ready to disrupt the industry for a number of years, and transformation has become a crucial driver for success. Therefore, enhancing the customer experience with digital transformation is integral.

Spending on insurance technology is expected to grow by more than 25% in the US and UK by 2026 (Insider Intelligence). According to Deloitte’s 2022 Insurance Industry Outlook, 74% of insurers plan to increase spending on AI, 72% on cloud computing and storage, 67% on data analytics, and 63% on mobile technology. This surge in investment demonstrates the anticipated return on investment from digital technology.

This blog delves into the key strategies and benefits of digital transformation in the insurance sector, highlighting how it can revolutionize customer interactions and reshape the landscape.

Understanding Digital Transformation

Before we explore its impact on customer experience, let’s define what digital transformation means in an insurance context. The insurance industry is traditionally known for its complex and lengthy processes. Customer frustration and dissatisfaction have been all too familiar realities for many insurers. But digital transformation involves leveraging advanced technologies and data-driven insights to streamline these operations, automate processes, and create seamless digital touchpoints for customers.

It encompasses a wide range of initiatives, including digitising paper-based processes, implementing AI and machine learning algorithms, adopting cloud-based platforms, and enhancing data analytics capabilities. But all of this orbits around one unified goal: customer-centricity.

The Customer-Centric Approach

The overarching goal of digital transformation is enabling your business to establish its initial customer engagement online and, consequently, craft seamless customer journeys. Customers now anticipate live chat support, streamlined services, personalised products, and self-service options. Digital transformation becomes a prerequisite for insurers looking to bridge the gap between their offerings and their audience.

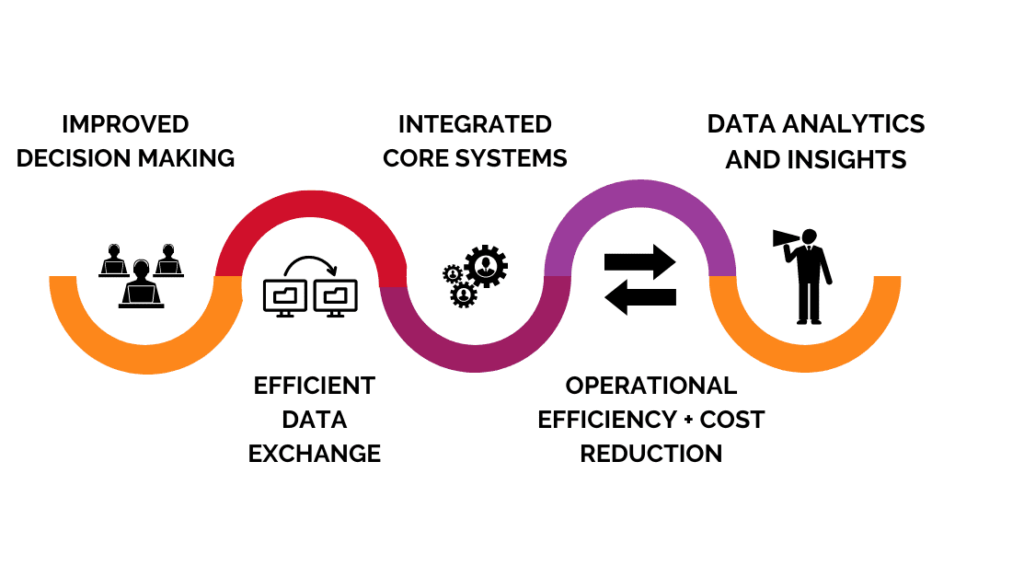

By collecting and analysing vast amounts of customer data, insurers can gain valuable insights into customer preferences, behaviours, and needs to tailor their offerings, recommend relevant products, and provide timely support, ultimately leading to improved customer satisfaction and loyalty. But there are a few other things at play.

1. Seamless Omni-Channel Experiences

In today’s multi-device, interconnected world, customers expect a seamless experience across various channels, including websites, mobile apps, social media, and call centers. A big part of digital transformation is integrating these channels, allowing customers to interact and transact through their preferred medium.

Whether it’s filing a claim, renewing a policy, or seeking assistance, customers can seamlessly switch between platforms without losing context, resulting in a frictionless experience and higher customer satisfaction.

2. Automation and Efficiency

By automating manual processes and utilising robotic process automation (RPA), insurers can improve efficiency and reduce turnaround times. Claims processing, policy underwriting, and document verification are just some of the areas that can benefit from automation.

Faster and more accurate processes lead to quicker resolutions, reduced paperwork, and enhanced operational efficiency, enabling insurers to focus on providing exceptional customer service.

3. Leveraging AI and Predictive Analytics

Digital transformation empowers insurance companies to leverage artificial intelligence (AI) and predictive analytics to gain deeper insights into customer behaviour. By analysing historical data and patterns, insurers can identify potential risks to enhance decision-making. They can also better personalise pricing models and offer targeted recommendations to customers.

This data-driven approach not only improves the customer experience but also helps insurers mitigate their own risks, preventing fraud and optimising their product offerings.

4. Enhanced Communication and Engagement

Digital transformation opens up new avenues for engagement between insurers and customers. Through interactive chatbots, virtual assistants, and self-service portals, customers can access real-time information, receive instant support, and get their queries resolved without the need for extensive wait times.

These accessible communication channels create a positive impression, increasing satisfaction and fostering long-term loyalty.

Final Thoughts

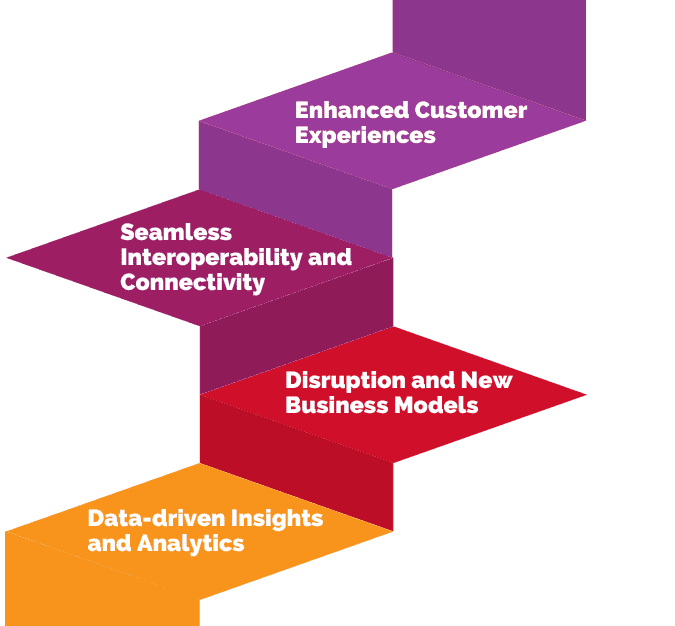

Digital transformation is a proven game-changer for enhancing customer experiences. The benefits extend far beyond satisfaction to increasing loyalty, reducing costs, and improving business outcomes. Insurance is only becoming more competitive, with innovative start-ups and tech-savvy specialists entering the market each and every day. Embracing digital transformation is a necessity for insurers aiming to stay competitive and not only engage with new audiences but keep long-standing customers from straying.