Did you know the global insurtech market is projected to reach over $166 billion by 2030? Technology is rapidly changing the insurance world, making once-complicated policies and processes smarter and more customer-friendly. Understanding the terms and core concepts behind insurtech helps you keep up with innovations that bring personalized coverage, faster claims, and safer data management to both companies and policyholders.

Table of Contents

- Defining Insurtech Terminology And Core Concepts

- Major Insurtech Categories And Types Explained

- Crucial Terms Across The Insurance Value Chain

- Technology Features Shaping Modern Insurtech

- Risks, Compliance, And Best Practice Guidelines

Key Takeaways

| Point | Details |

|---|---|

| Insurtech Transformation | Insurtech leverages advanced technologies to enhance efficiency and personalization in the insurance process, addressing traditional industry challenges. |

| Key Categories | Major insurtech categories include digital brokers, peer-to-peer insurance, and telematics, each serving distinct purposes within the insurance ecosystem. |

| Technology Features | Modern insurtech integrates technologies like AI, machine learning, and blockchain to redefine risk management and improve customer engagement. |

| Risk and Compliance | Comprehensive risk management and compliance strategies are critical, requiring robust cybersecurity measures and adaptive practices to meet evolving regulations. |

Defining Insurtech Terminology and Core Concepts

Insurtech represents a revolutionary approach to transforming traditional insurance processes through advanced technological integration. According to Corporate Finance Institute, insurtech involves the innovative use of technology to enhance and streamline insurance industry operations, making processes more efficient and cost-effective.

At its core, insurtech encompasses a wide range of technological solutions designed to reimagine how insurance products are developed, distributed, underwritten, and managed. These solutions leverage emerging technologies like artificial intelligence, machine learning, blockchain, and advanced data analytics to create more personalized, responsive, and dynamic insurance experiences. Key technological innovations include predictive risk modeling, automated claims processing, real-time pricing algorithms, and digital customer engagement platforms.

The primary objectives of insurtech extend beyond mere technological implementation. Digital transformation in insurance aims to address long-standing industry challenges such as complex customer interactions, inefficient legacy systems, and rigid product offerings. By integrating cutting-edge technologies, insurtech enables property and casualty (P&C) insurers to develop more flexible, data-driven strategies that can quickly adapt to changing market dynamics. Understanding Digital-First Insurance Strategies becomes crucial in this evolving landscape.

Modern insurtech solutions focus on several critical dimensions:

- Enhanced customer experience through intuitive digital interfaces

- Real-time risk assessment and personalized pricing models

- Automated underwriting and claims processing

- Improved operational efficiency and cost reduction

- Advanced data analytics for more accurate decision-making

Major Insurtech Categories and Types Explained

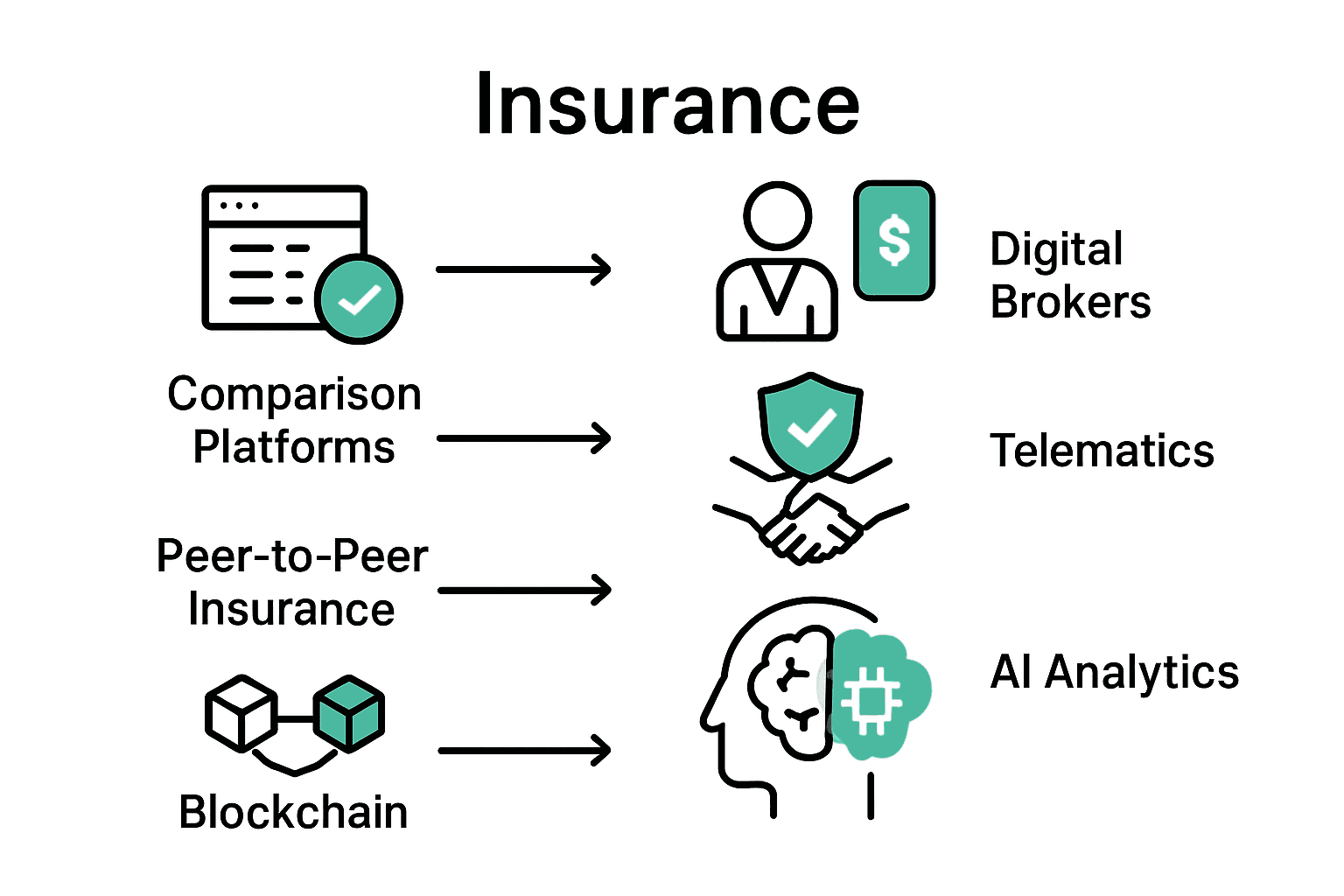

Insurtech categories represent the diverse technological approaches transforming the insurance landscape. According to research from Cenfri, insurtech initiatives can be categorized into six primary types: new data and analytics, digital brokers, peer-to-peer insurance, on-demand insurance, telematics, and microinsurance.

Expanding on these categories, Institute of Insurance Research highlights additional critical insurtech types that are reshaping the industry. These include comparison portals, digital insurance sellers, cross-platform insurance marketplaces, digital insurers, big data analytics platforms, insurance software solutions, Internet of Things (IoT) integrations, and blockchain-powered smart contract systems. Types of Insurance Platforms provides deeper insights into these technological innovations.

Each insurtech category serves unique strategic purposes within the insurance ecosystem.

Digital brokers streamline distribution channels, peer-to-peer models enable community-based risk sharing, and telematics platforms leverage real-time data for personalized pricing. On-demand insurance offers flexible coverage options, while microinsurance solutions extend protection to underserved market segments.

Digital brokers streamline distribution channels, peer-to-peer models enable community-based risk sharing, and telematics platforms leverage real-time data for personalized pricing. On-demand insurance offers flexible coverage options, while microinsurance solutions extend protection to underserved market segments.

Key insurtech categories include:

Here’s a comparison of major insurtech categories and their key features:

| Category | Main Purpose | Notable Technologies |

|---|---|---|

| Comparison Platforms | Transparent product evaluation | Web portals APIs |

| Digital Brokers | Streamlined insurance purchasing | Cloud platforms Chatbots |

| Peer-to-Peer Insurance | Community-based risk sharing | Blockchain Digital wallets |

| Telematics Solutions | Usage-based, real-time pricing | IoT sensors GPS tracking |

| Blockchain Platforms | Secure and transparent transactions | Smart contracts DApps |

| AI-Powered Analytics | Enhanced risk and customer insights | Machine learning Predictive analytics |

- Comparison Platforms: Enabling transparent insurance product comparisons

- Digital Brokers: Simplifying insurance purchasing processes

- Peer-to-Peer Insurance: Facilitating community-driven risk management

- Telematics Solutions: Utilizing real-time data for dynamic pricing

- Blockchain Platforms: Creating secure, transparent insurance transactions

- AI-Powered Analytics: Enhancing risk assessment and customer insights

Crucial Terms Across the Insurance Value Chain

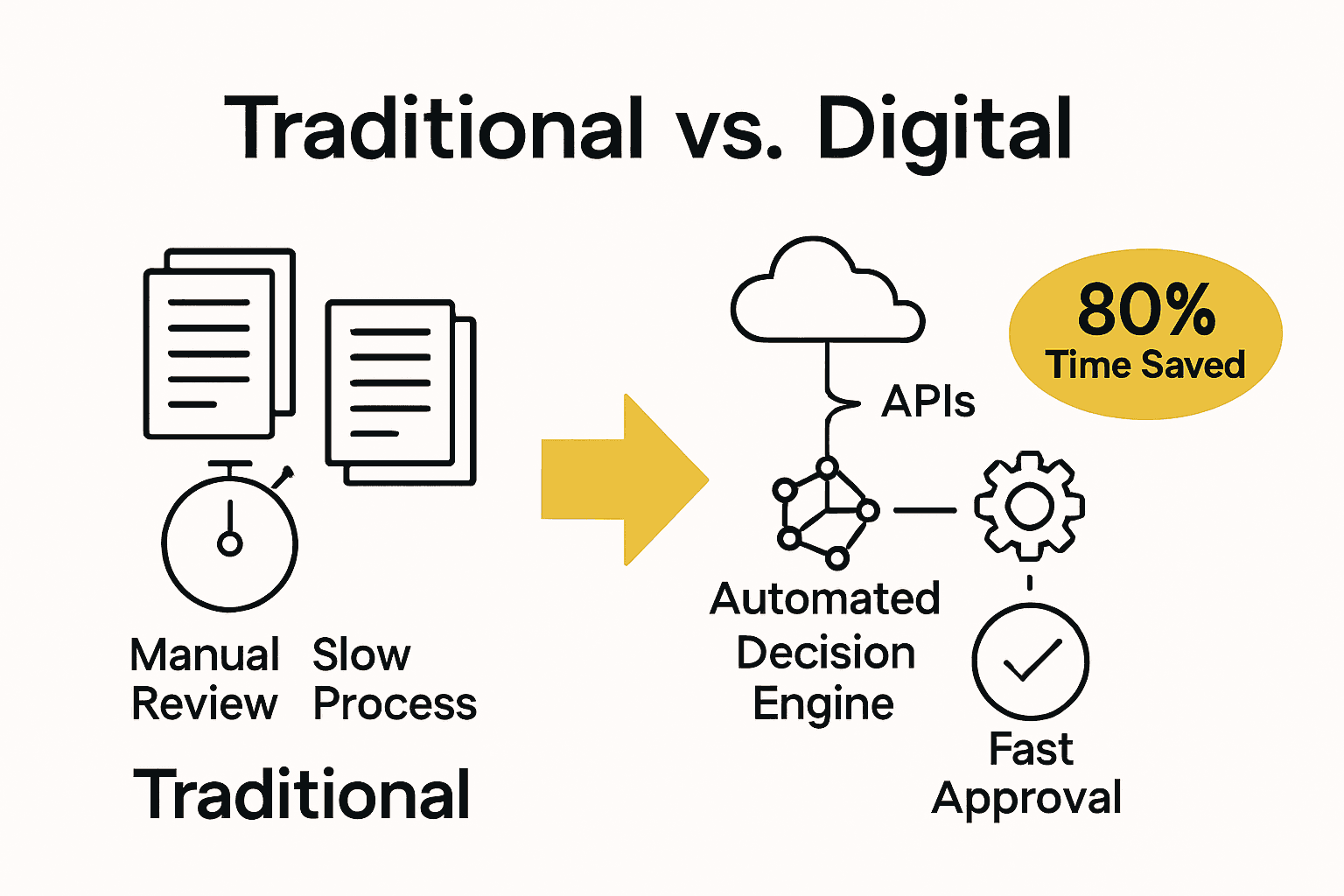

The insurance value chain represents a complex ecosystem of interconnected processes that transform how risk is managed and mitigated. According to research from Resolve Cambridge, the insurance value chain encompasses various critical phases including product development, underwriting, distribution, policy management, and claims settlement, with insurtech technologies driving transformative changes across each stage.

Digital transformation has fundamentally reshaped traditional insurance workflows. Core Insurance Systems highlights how modern insurtech solutions are revolutionizing each component of the value chain. From MDPI research, an effective insurtech ecosystem integrates key terminology like digital underwriting processes, automated claims processing, personalized policy structures, and data-driven risk assessment techniques.

Understanding the nuanced terminology across the insurance value chain becomes crucial for professionals navigating this complex landscape. Each stage requires specialized knowledge and technological expertise to optimize operational efficiency and customer experience. Key terminology spans technical domains like predictive analytics, machine learning algorithms, blockchain verification, real-time data integration, and automated risk modeling.

Critical terms across the insurance value chain include:

- Underwriting: Risk assessment and policy pricing mechanisms

- Claims Processing: Automated damage evaluation and settlement workflows

- Distribution: Digital channels and intermediary management platforms

- Policy Administration: Lifecycle management and customer interaction systems

- Risk Modeling: Predictive analytics and probabilistic assessment techniques

- Regulatory Compliance: Digital governance and reporting frameworks

Technology Features Shaping Modern Insurtech

Modern insurtech is characterized by a sophisticated array of transformative technologies that fundamentally reshape risk management and customer interactions. According to Cenfri, contemporary insurtech platforms leverage advanced technologies like telematics, machine learning, artificial intelligence, and chatbots to automate processes and dramatically enhance customer engagement.

Opportunities for P&C Insurers illustrate how these technological innovations are driving unprecedented changes across the insurance landscape. From The Intellify, key technologies defining modern insurtech include peer-to-peer insurance models, on-demand insurance solutions, usage-based insurance approaches, and microinsurance platforms that democratize risk protection.

The technological ecosystem of modern insurtech extends far beyond traditional computational approaches. Emerging technologies now integrate complex systems like blockchain for secure transactions, Internet of Things (IoT) sensors for real-time risk monitoring, advanced predictive analytics for personalized pricing, and sophisticated machine learning algorithms that can assess risk with unprecedented accuracy. These technologies work synergistically to create more responsive, transparent, and customer-centric insurance experiences.

Critical technology features driving modern insurtech include:

- Artificial Intelligence: Enabling predictive risk assessment

- Machine Learning: Developing dynamic pricing models

- Blockchain: Ensuring secure, transparent transactions

- IoT Sensors: Providing real-time risk monitoring

- Chatbots: Enhancing customer service interactions

- Telematics: Creating usage-based insurance solutions

Risks, Compliance, and Best Practice Guidelines

Cyber risk management has become a critical component of modern insurance technology strategies. Research from arXiv highlights the complex challenge of modeling and pricing cyber insurance, emphasizing the need to consider idiosyncratic, systematic, and systemic risks that traditional actuarial methods might not adequately address.

Cybersecurity for Insurers underscores the importance of comprehensive risk mitigation approaches. According to additional arXiv research, the homogeneity of risk models in the insurance industry can potentially create systemic vulnerabilities, making it crucial to promote diversity in risk assessment methodologies to ensure sector stability.

Navigating the intricate landscape of insurance compliance requires a multifaceted approach that integrates technological innovation with robust regulatory frameworks. Modern insurtech organizations must develop sophisticated risk management strategies that balance technological advancement with stringent compliance requirements. This involves implementing advanced cybersecurity protocols, developing adaptive risk assessment models, maintaining transparent data governance, and creating agile compliance management systems that can quickly respond to evolving regulatory landscapes.

Key best practice guidelines for risk and compliance include:

- Comprehensive Risk Assessment: Develop multi-dimensional risk models

- Cybersecurity Protocols: Implement robust digital security measures

- Regulatory Alignment: Maintain continuous compliance monitoring

- Data Governance: Ensure transparent and secure data management

- Adaptive Compliance: Create flexible regulatory response mechanisms

- Continuous Training: Develop ongoing risk awareness programs

Unlock the Full Potential of Insurtech with IBA’s Core Insurance Platform

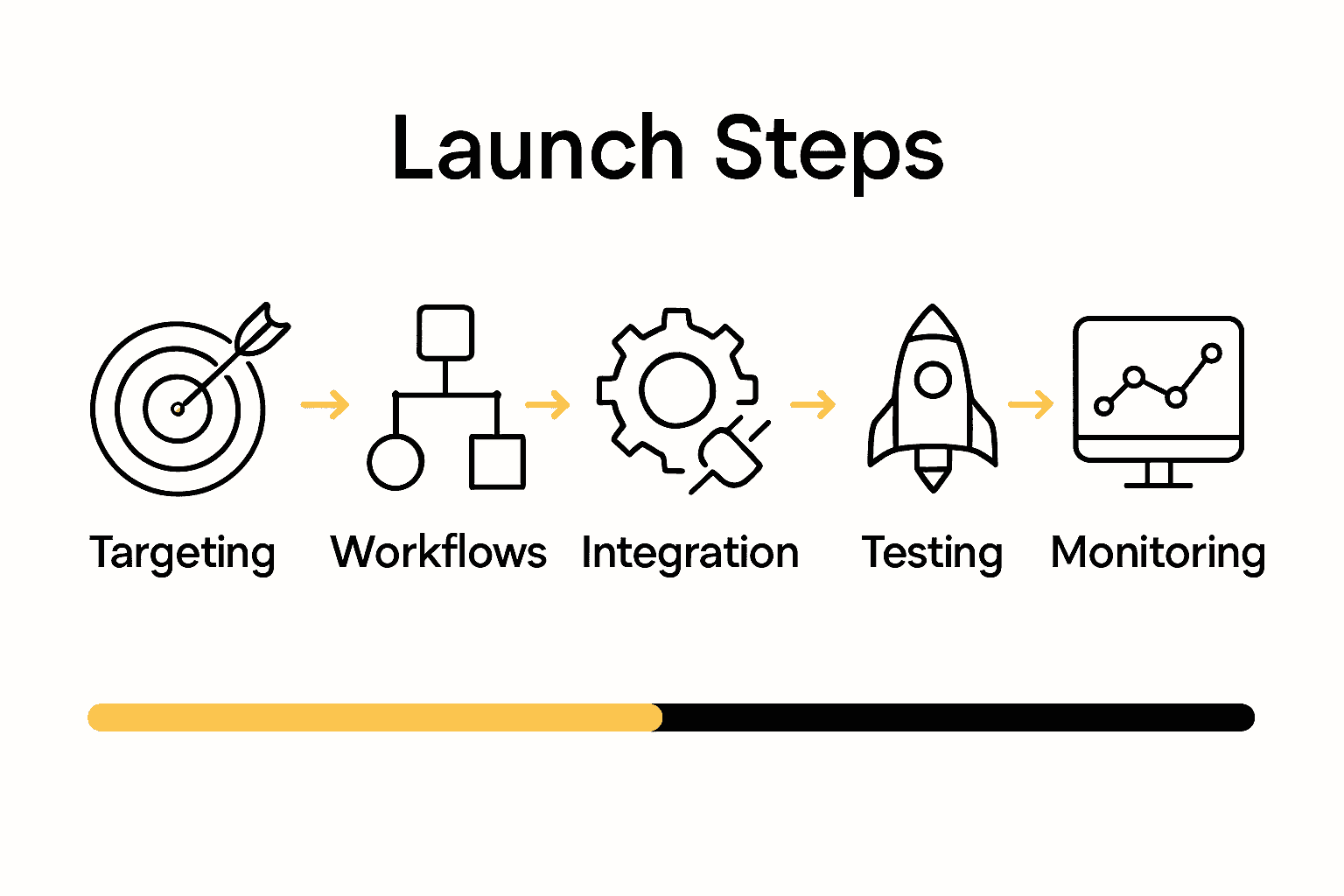

Navigating the complex insurtech terminology and mastering the insurance value chain can be overwhelming. The article highlights crucial challenges such as streamlining underwriting, automating claims processing, and ensuring regulatory compliance while leveraging technologies like AI, blockchain, and telematics. If you are striving to reduce IT complexity and accelerate digital transformation in property and casualty insurance, these pain points and goals resonate deeply.

At Insurance Business Applications, we understand these critical needs. Our cloud-native platform, IBSuite, empowers insurers to seamlessly integrate advanced technologies that drive efficiency across distribution, policy administration, risk modeling, and beyond. With secure, API-first architecture, IBSuite supports dynamic pricing models and real-time data integration to enhance your competitive edge.

Are you ready to simplify your digital transformation journey and elevate your insurer’s capabilities with modern insurtech solutions? Discover how IBSuite can transform your operations, enable rapid product innovation, and ensure evergreen compliance by booking a personalized demo today. Experience firsthand how our platform helps you embrace new distribution models and adapt quickly to market changes. Take the next step now at Book a Demo and start accelerating your P&C insurer’s success.

Frequently Asked Questions

What is insurtech?

Insurtech refers to the innovative use of technology to enhance and streamline various processes within the insurance industry, making them more efficient and cost-effective.

What are the main categories of insurtech?

Insurtech can be categorized into several types, including comparison platforms, digital brokers, peer-to-peer insurance, telematics, on-demand insurance, and microinsurance, among others.

How does digital transformation impact the insurance industry?

Digital transformation in the insurance industry aims to address challenges such as complex customer interactions and inefficient legacy systems, allowing for more flexible, data-driven strategies that adapt quickly to market changes.

What are some critical technologies driving modern insurtech?

Key technologies shaping modern insurtech include artificial intelligence for predictive risk assessment, machine learning for dynamic pricing models, blockchain for secure transactions, and IoT sensors for real-time risk monitoring.

Recommended

- Opportunities and Challenges for P&C Insurers: Embracing Insurtech – Digital Insurance Platform | IBSuite Insurance Software | Modern Insurance System

- Innovating the Product Landscape with Parametric Insurance – Digital Insurance Platform | IBSuite Insurance Software | Modern Insurance System

- Embedded Insurance and its Importance: Part 1 – Digital Insurance Platform | IBSuite Insurance Software | Modern Insurance System

- Automation and Artificial Intelligence in P&C Insurance – Digital Insurance Platform | IBSuite Insurance Software | Modern Insurance System

Machine learning algorithms can now predict risk scenarios with unprecedented accuracy, automate complex claims processing, and generate dynamic underwriting models. This technological evolution means faster claims resolution, more accurate pricing, and a dramatically improved customer experience that anticipates needs before they become critical problems.

Machine learning algorithms can now predict risk scenarios with unprecedented accuracy, automate complex claims processing, and generate dynamic underwriting models. This technological evolution means faster claims resolution, more accurate pricing, and a dramatically improved customer experience that anticipates needs before they become critical problems.

The strategic integration of these technologies enables insurance companies to shift from reactive to proactive regulatory management, creating more resilient and adaptable operational frameworks.

The strategic integration of these technologies enables insurance companies to shift from reactive to proactive regulatory management, creating more resilient and adaptable operational frameworks.